The journey to school has examined the resolve of Jonathan Cornejo, a senior at West Adams Preparatory Excessive Faculty in central Los Angeles. The son of a single immigrant mom from El Salvador, he had no dwelling Wi-Fi or working laptop computer for stretches at a time or a examine area within the household’s cramped house.

He typically felt misplaced in his faculty preparatory lessons and couldn’t at all times discover the assistance he wanted. But Jonathan overcame these challenges to earn a 4.0 GPA whereas serving as scholar physique president and yearbook editor in chief. His perseverance paid off final month when he acquired a coveted admission provide from his dream college, top-rated UC San Diego.

However Jonathan is planning to go to a neighborhood faculty. Even with a considerable monetary help provide, he can’t afford to attend the College of California — and he’s not alone.

His plight is mirrored throughout the UC system, as rising faculty prices compounded by inflation and pandemic fallout put dream campuses out of attain for a lot of college students. Greater than 10,000 of the state’s lowest-income college students admitted to UC are selecting as an alternative to attend California neighborhood schools or California State College, partly attributable to monetary shortfalls. At UC, the share of undergraduates who obtain Pell Grants — federal help for the neediest college students — has dropped over the past decade.

Jonathan’s monetary help bundle left a $4,000 funding hole he says he can’t fill with earnings from his part-time job as a Starbucks barista or his mom’s two low-wage jobs as a prepare dinner. He and his mom are fearful in regards to the monetary burdens of taking out a mortgage. He’s hoping he erred in filling out his software for federal monetary help and can get extra help as soon as he amends it.

“I cried about it, I cannot lie,” Jonathan stated about his monetary help shortfall. “You probably did all this stuff, tried your finest. You then have a look at the cash side and see you possibly can’t afford it.”

Jonathan Cornejo, left, and Emily Gramajo, are each college students at West Adams Preparatory Excessive Faculty. Each are discovering that they’ll’t afford a four-year college.

(Francine Orr / Los Angeles Occasions)

Rising monetary challenges like Jonathan’s are deepening issues all through UC that among the state’s poorest college students could also be lacking out on the system’s top-notch schooling, which may propel them to the very best echelons of wage earners and gasoline the longer term state financial system. UC delivers the very best completion charges and post-graduate earnings amongst California’s three public higher-education techniques.

“We’re very involved about these developments, as a result of the college’s mission may be very tightly related to upward mobility and enabling everybody to come back to the College of California, particularly low-income, first-generation and minority college students,” stated UC Provost Katherine Newman. “That is one thing we just about discuss on daily basis.”

The share of UC college students with incomes low sufficient to obtain Pell Grants dropped to 33% in fall 2022 in contrast with 42% in fall 2012, in line with systemwide information.

Nationally, rising incomes are pushing extra college students out of eligibility for Pell Grants even when they nonetheless can’t absolutely afford faculty in high-cost states like California. The price of dwelling in Los Angeles, as an example, is 40% greater than in Houston. However the Pell program makes no geographical changes. Most Pell recipients have household incomes underneath $50,000.

Among the many lowest-income college students admitted to UC, the quantity who chosen CSU as an alternative doubled to six,946 in fall 2021 from 2015 and likewise doubled for neighborhood schools, to three,063 college students, the info present. Total, the share of first-year college students with annual household incomes of lower than $50,000 who enrolled at UC dropped to 39.7% in 2021 from 54.4% in 2015. Related downward developments are evident amongst college students who’re the primary of their households to attend faculty.

UC information do not establish the particular purpose college students are choosing CSU and neighborhood schools. Marisol Cuellar Mejia, a Public Coverage Institute of California analysis fellow, stated some might not be capable of afford it and a few might have been denied admission to their high UC selections and wish to attempt once more by way of the switch route.

As well as, UC information present way more low-income college students select neighborhood faculty than these with greater household incomes. Group schools stay an economical choice for college kids who’re disciplined of their research — and UC is creating new pathways to widen switch accessibility.

Monetary help shortfalls

Newman stated a number of “hefty headwinds” are driving down the variety of low-income college students at universities throughout the nation. In California, the important thing barrier to school affordability is the rising value of housing, which monetary help normally doesn’t absolutely cowl — not like tuition, which is paid by the state’s beneficiant Cal Grant program for lower-income state college students.

The UC system’s 9 undergraduate campuses are situated in among the nation’s priciest actual property markets; off-campus dwelling prices climbed by a median 54% systemwide between 2014-15 and 2022-23, with greater will increase at UC Berkeley, UCLA, UC Irvine and UC Santa Cruz, in line with UC information.

However commuting will not be typically an choice since UC campuses are farther from dwelling for a lot of college students than the 23 CSU and 115 California Group Faculty campuses. Many low-income college students, reminiscent of Jonathan, don’t have automobiles.

“For college kids who’re first-generation and low-income, having the ability to shelter of their mother and father’ dwelling helps to chop the prices, and that tends to tie them to native areas, greater than extra prosperous college students who can decide up and transfer into dormitory housing,” Newman stated.

In recent times, the state’s sturdy labor market has most likely pulled some low-income college students admitted to UC into jobs as an alternative, Newman stated. And extra college students could also be hesitant to go away dwelling as a result of the pandemic fallout has elevated their household obligations or made them cautious about rooming with strangers.

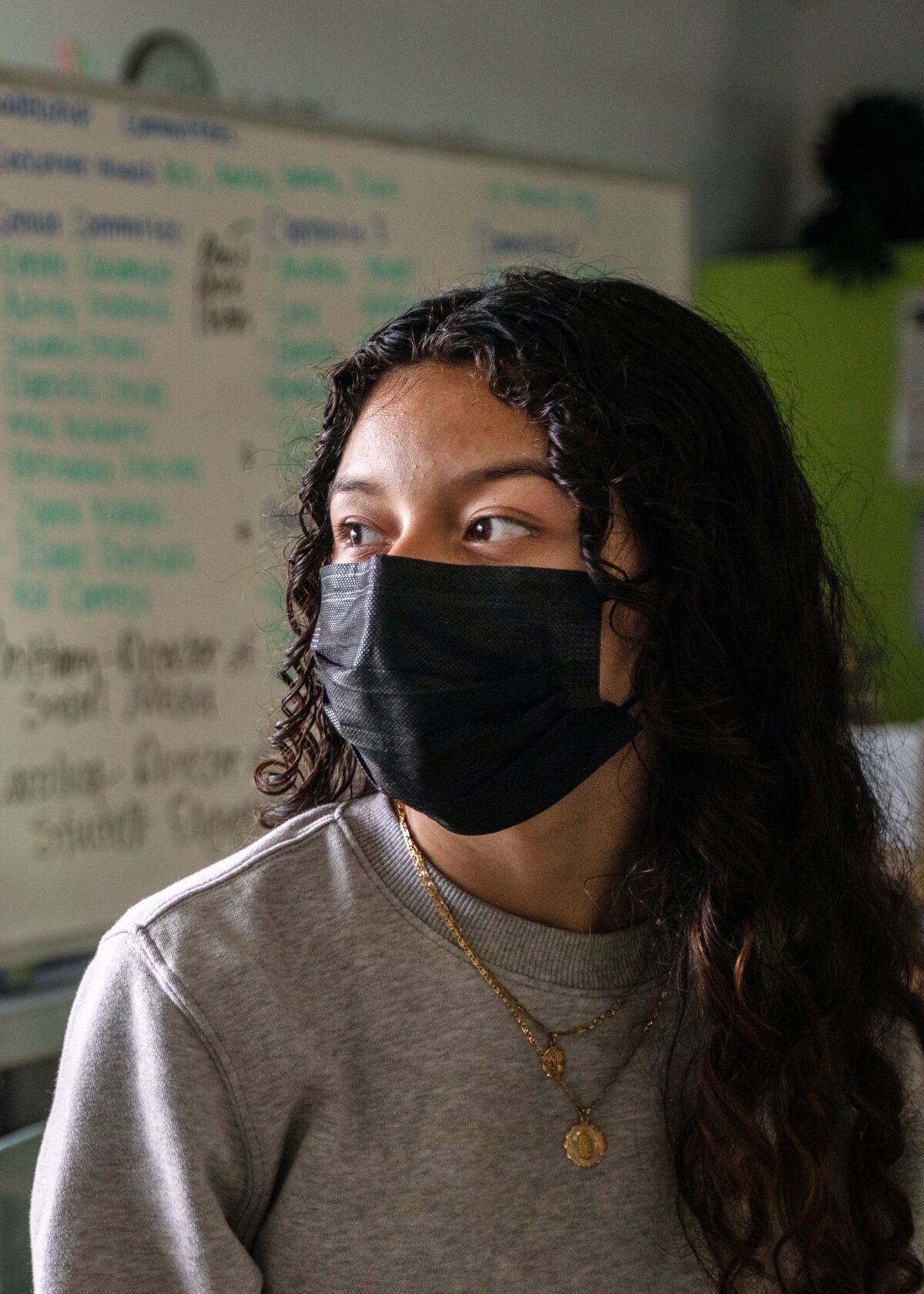

Due to prices, Emily Gramajo, a scholar at West Adams Preparatory Excessive Faculty in Los Angeles and a president of the senior class, is choosing neighborhood faculty.

(Francine Orr / Los Angeles Occasions)

Emily Gramajo, a senior at West Adams Preparatory Excessive, has a waitlist provide from UC Riverside and acceptances from Cal State campuses at Northridge and Dominguez Hills. However even when she will get off the Riverside waitlist, she’s already determined to attend L.A. Metropolis Faculty as a result of the primary two years can be free underneath the California Faculty Promise Grant program. She stated she is required at dwelling to scrub, prepare dinner, take out the canine and baby-sit for her neighbors. She additionally stated she would really feel safer at dwelling, having heard about “scary” dorm experiences.

She stated she’s “just a little unhappy” about lacking a four-year college expertise out of highschool. “However I really feel like it might profit me higher if I’m going to neighborhood faculty first as a result of I may save up all of my cash and I may switch in my final two years to a college,” Emily stated.

Counselors at a number of L.A. Unified excessive colleges have famous the pattern of UC-eligible college students turning down admission gives with dismay. At Banning Excessive Faculty in Wilmington, counselor Araceli Fernandez stated she pushes her college students to decide on a four-year college as a result of she’s seen too many college students “lose focus” and take three or 4 years to finish a two-year neighborhood faculty program — or find yourself failing to switch.

Many mother and father, who might not have attended faculty and are struggling economically, see UC’s greater sticker worth and don’t wish to take out loans to cowl monetary shortfalls as a result of they’re afraid they received’t be capable of pay them again, Fernandez stated. She’s had college students flip down UCLA — essentially the most applied-to college within the nation — due to the price.

“They don’t say oh my God, UCLA is the highest public college within the nation and if I simply take out a mortgage of $3,000 a 12 months, I may go there or Berkeley,” Fernandez stated. “They only have a look at that worth and so they simply say no.”

Jacqueline Villatoro, the West Adams faculty counselor, shares her personal story of taking out loans — $30,000 as an undergraduate — to get by way of UC San Diego because the daughter of a single mom from Guatemala. She spent most of it not on campus housing however on commuting to San Diego from L.A. as a result of her mom may solely discover a job as a live-in nanny after the 2008 recession. Three or 4 occasions per week, Villatoro dropped off her youthful sister at a relative’s home, hit the street to San Diego by 5:30 a.m. and rushed dwelling after her midday class to choose her up from college.

Faculty counselor Jacqueline Villatoro, proper, works with a scholar at West Adams Preparatory Excessive Faculty in Los Angeles.

(Francine Orr / Los Angeles Occasions)

She tells households that scholar loans is usually a worthwhile funding — particularly for STEM college students headed for high-paying careers — however she typically finds “mother and father are scared to take that leap.”

Over time, fewer UC college students are taking out loans, though college information don’t clarify why. UC undergraduates with federal loans dropped to 55,214, or 23.6% of undergraduates, in 2021-22. Through the 2011-12 tutorial 12 months, 85,109, or 46.1% took out federal loans, UC information present.

Throughout her 10 years as a school advisor, Villatoro stated she’s seen monetary help packages protecting a smaller share of rising faculty prices. Pell Grants, as an example, pay for lower than 30% of the price of four-year public schools at present in contrast with 75% in 1980 — prompting a nationwide marketing campaign to double the grant.

However though UC’s whole value of attendance is highest among the many state’s three public greater schooling techniques, its campus institutional help can be the most important, she famous. That usually ends in smaller monetary shortfalls.

Jonathan’s unmet want for UC San Diego, as an example, is $4,000 — however about $14,000 at San Francisco State, whose value of attendance is significantly decrease. That’s as a result of the Bay Space campus provided no institutional help whereas UC San Diego is offering a $10,368 grant.

More cash sooner or later

UC is stepping up its monetary help each systemwide and at particular person campuses. The UC regents raised tuition for incoming undergraduates starting final fall and put aside a bigger share of the brand new income — 45% — for monetary help. That raised an extra $16 million for UC’s need-based monetary help program, which disbursed a complete $864 million in grants in 2021-22.

UC President Michael V. Drake has additionally launched a “debt-free path” program to offer college students with sufficient grants and work-study alternatives to cowl the price of faculty with out loans. UC officers are phasing in this system, planning to supply it to one-quarter of recent incoming college students this fall and all undergraduates by 2030, stated Shawn Brick, UC government director of scholar monetary help.

Moreover, Gov. Gavin Newsom and state legislators have expanded Cal Grants and scholarships for middle-class college students to cowl extra dwelling bills and tuition. The expansions may take impact subsequent 12 months relying on the state’s income projections.

A Pell Grant change is anticipated to extend the variety of eligible college students whereas simplifying the difficult software. UC initiatives as many as 11,000 extra college students may qualify for a Pell in 2024, Brick stated.

All of which may assist UC keep within the forefront of inexpensive schooling. The proportion of UC college students within the backside 30% of earnings ranges — about $66,000 a 12 months or much less — continues to develop, Newman stated.

“I feel there’s lots for the college to be pleased with, however we’re not going to relaxation on any laurels,” Newman stated. “Once we see these [Pell] numbers go down, we get very involved about it.”

Jonathan Cornejo, left, and Emily Gramajo stroll to class by way of the courtyard at West Adams Preparatory Excessive Faculty in Los Angeles.

(Francine Orr / Los Angeles Occasions)

Jonathan, for his half, nonetheless desires of attending UC San Diego. He imagines himself pursuing his love for science — possibly physiology or human biology, a fascination first sparked by watching “Gray’s Anatomy.” He yearns to go away his L.A. confines and begin an impartial life in a brand new atmosphere. He would like to have his personal place to check, even look out of a dorm window and see the ocean.

He has a few week left earlier than the nation’s Might 1 faculty dedication day. Perhaps, he says, a miracle will occur.